Trading rewards the trader who keeps learning. The market never stays still for long. It shifts from calm to volatile, from trending to choppy, from clear signals to confusing movement. A trader who treats this craft as something to study, rather than something to conquer, adapts far faster than someone who only looks for the next quick win.

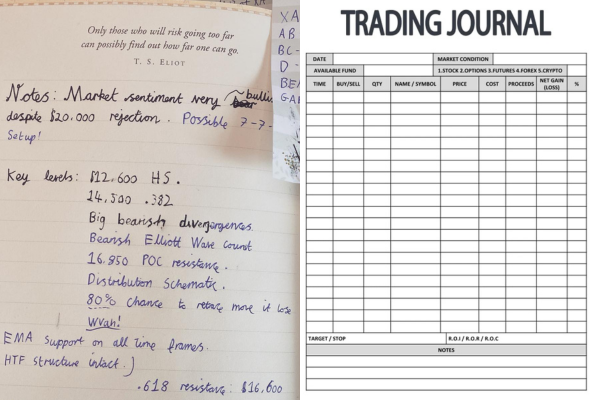

One of the most effective ways to learn is by keeping a journal. A trading journal is not just a record of numbers. It is a record of your decisions, the thoughts behind them, and the emotions you felt while taking them. Over time, these notes reveal patterns that you cannot see in the moment.

A useful journal entry includes four simple elements:

1. The reason you entered the trade

Why the setup made sense, and what you expected to happen.

2. The structure of the trade

Your entry, stop, target, and the conditions that defined the idea.

3. What you felt while the trade was active

Stress, confidence, hesitation, or impatience. These emotions matter.

4. The final result and your reflection

What you learned, and what you would repeat or change next time.

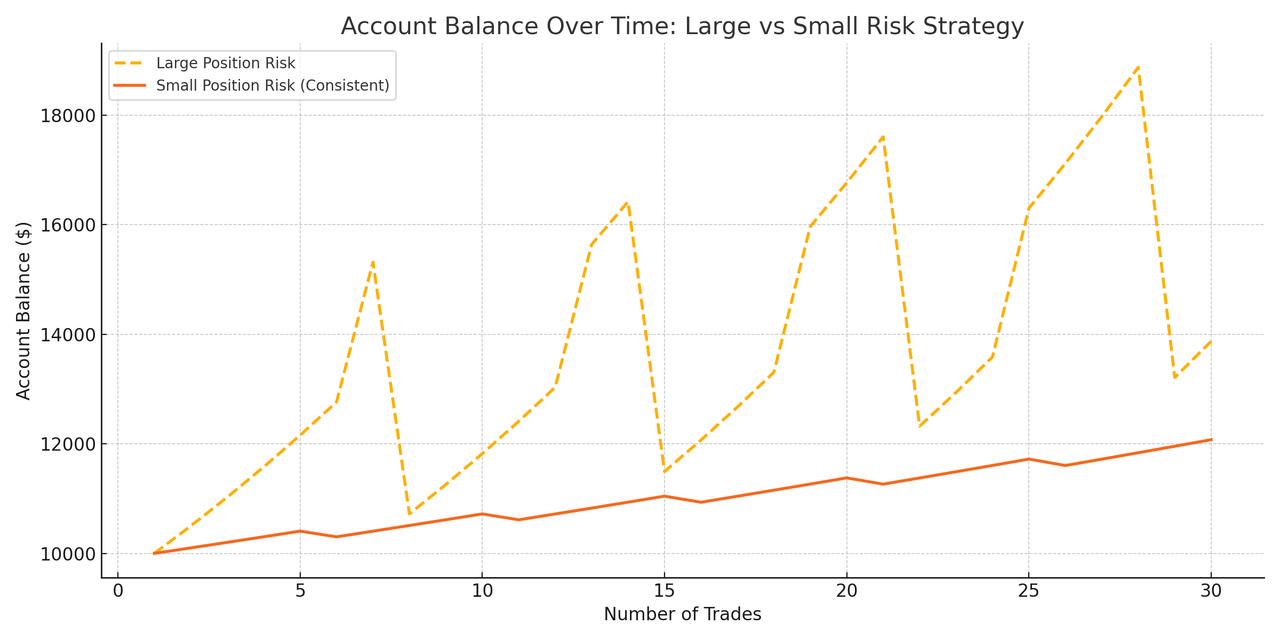

Consistency is not an outcome.

It is a habit repeated long enough to become instinct.

This kind of self-review builds awareness. For example, after a few weeks of journaling, you might notice that most of your losing trades came from impatience during slow markets. You might also notice that the trades you entered calmly, using your full process, performed better than expected. Insights like these shape your growth far more than trying a new indicator ever will.

A student mindset also means paying attention to the market itself. Watch how price reacts to key levels. Watch how volume behaves during breakouts. Watch how the chart moves during different times of day. The more you observe, the more intuitive your decisions become.

Learning is a continuous cycle. You trade, you reflect, you adjust. Each cycle sharpens your skill and strengthens your discipline. Over time, this approach turns confusion into clarity and randomness into structure.

A trader who keeps learning stays in the game. A trader who stays in the game eventually grows.