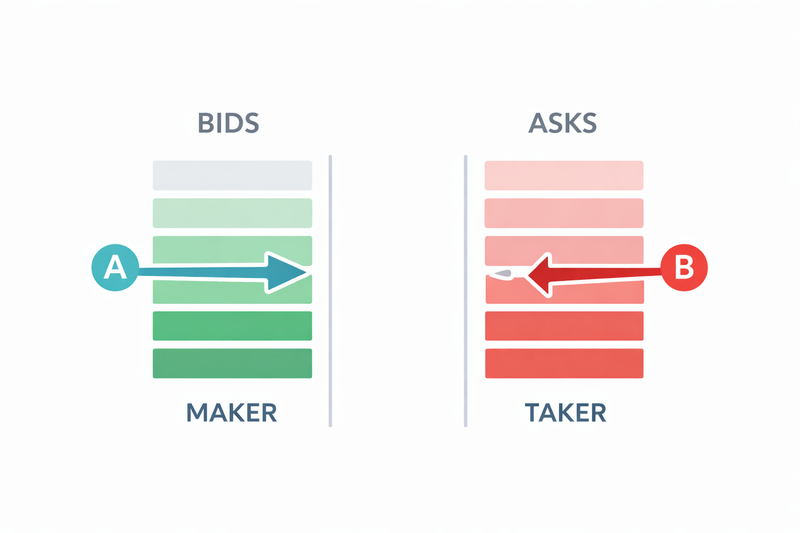

If you’re comparing venues, Bybit trading fees follow the standard maker/taker logic—so your execution style (resting vs crossing) is often more important than obsessing over a single headline rate. That´s why we highlight Bybit in our ecosystem.

This is where intermediate traders can level up fast: you can improve your fee profile without changing your strategy at all – just by upgrading how you execute the same setup. In other words, maker taker fees aren’t just an exchange detail; they’re part of your execution design.

Entry execution:

If your strategy buys pullbacks, you usually don’t need instant fills. A resting limit at your level can earn maker-style execution and keep fees lower – instead of paying taker fees because you got impatient and clicked market.

If your strategy trades breakouts, it’s often the opposite. Here, timing is the edge. Missing the move can cost more than the fee, so taker-style execution can be the correct choice – as long as you’re choosing it intentionally.

Exit execution:

This is where most traders leak money. They optimize entries, then blow it on exits when emotions hit. The classic pattern looks like this: maker entry → panic taker exit, which means your average fee rate rises and your worst slippage happens exactly when you’re stressed.

A cleaner approach is to plan exits with the same discipline as entries.

Decide in advance which exits must be instant (taker) – invalidations, stop-outs, fast risk-off moments – and which can rest (maker) – profit targets, partials, and structured scaling.

The bottom line is simple: maker saves on fees, taker buys certainty. Your edge improves when you decide deliberately, scenario by scenario, instead of defaulting into taker execution when the market speeds up.