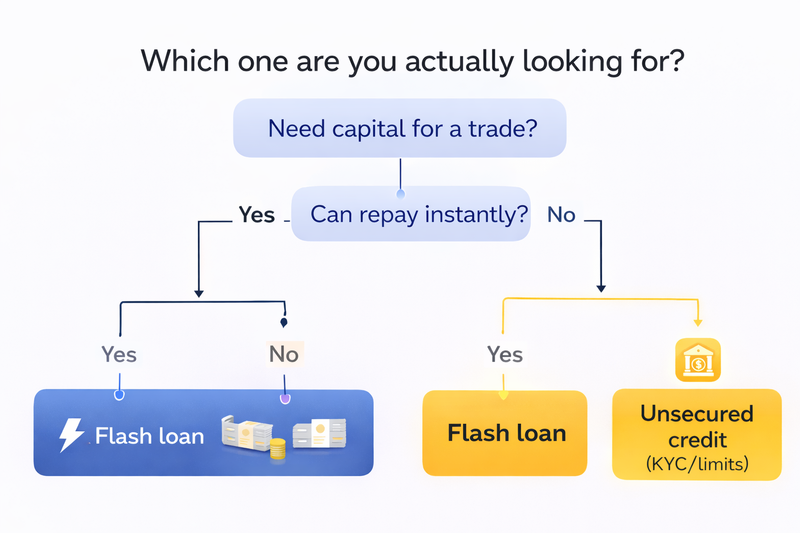

No-collateral crypto loans aren’t one product — they’re a label people use for two completely different mechanisms. It’s easy to assume you’ve found “free liquidity,” when in reality you’re either looking at an advanced, atomic transaction (flash loans) or an approval-based loan that still comes with strict limits, higher rates, and real consequences for missed repayments.

So before you decide whether this is useful for you as a trader, it helps to understand which category you’re actually dealing with — because the risks, costs, and “who this is for” are completely different.

Flash loans in DeFi (true no-collateral, but instant)

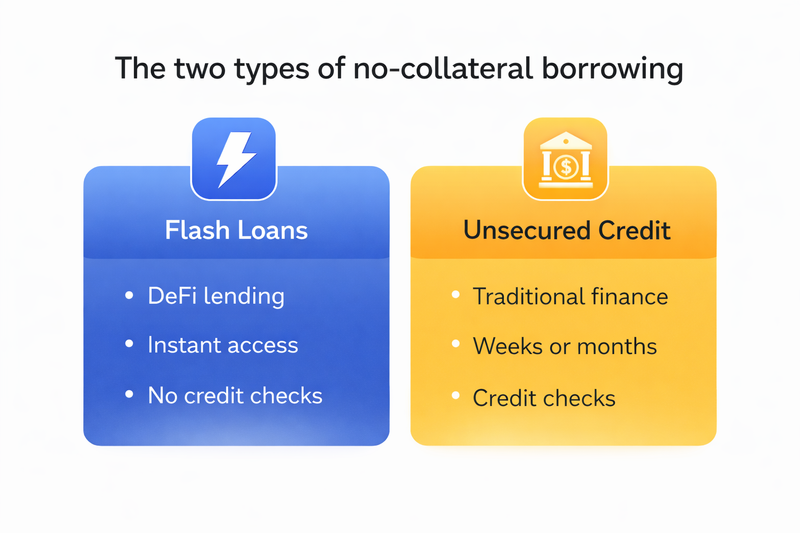

A flash loan is borrowed and repaid in a single transaction. If the sequence of actions can’t repay the lender, the chain reverts everything as if it never happened. That “all-or-nothing” property is what makes flash loans possible without collateral.

For traders, the key takeaway is this: flash loans are not “borrow money to trade.” They are a tool for executing a bundled set of actions that ends with repayment. That’s why flash loans are common in arbitrage and position management workflows, but rare as a retail funding method.

A non-technical mental model is helpful here. Imagine a flash loan as a “one-click bundle” that borrows capital, executes an action, and repays immediately. If any step fails — price moved too far, liquidity wasn’t there, fees were too high — the whole thing cancels. You may still lose transaction fees, and in some cases you can lose more if the strategy interacts with complex components.

This is also where execution costs become decisive. If you don’t understand how fills and fees affect outcomes, you will misjudge whether an “edge” is real. Two pages that help traders build that foundation are what slippage is in crypto and maker vs taker fees.

Unsecured or reputation-based loans (weeks to months)

Credit-style “unsecured” loans are a different category. Here, you’re approved for a limit and you repay over time. These models are rarer in crypto because enforcement is harder and volatility makes underwriting tricky, so approval usually depends on a combination of identity verification, history, and risk limits.

Some systems use on-chain behavior signals. Others rely heavily on KYC and compliance. Either way, unsecured crypto loans tend to work like this: the lender limits the amount, prices the risk higher, and tracks repayment to decide whether you qualify again.

If you’re expecting “instant, large loans with no questions,” you’re likely looking at marketing — or at a product that will be expensive, restrictive, or risky in ways that aren’t obvious on the landing page.