Crypto Prop Trading Firms vs Crypto Funds: What’s the Difference?

Discover the key differences between crypto prop trading firms and crypto funds — strategies, risks, and opportunities in digital asset markets.

Trading•1 September 2025

Two Playbooks, One Game: Prop Firms vs Funds

Imagine two people sitting at the same poker table. One is playing with his own chips — every win or loss hits him directly. The other is playing with money fronted by a crowd of backers, taking a cut if things go well. Both are technically in the game, but their relationship to risk, discipline, and incentives couldn’t be more different. That, in a nutshell, is the split between crypto prop firms and crypto funds.

To most outsiders, both fall under the same umbrella of “professional traders”. But lumping them together misses the point. The incentives, structures, and even the cultures that drive them are very different — and understanding those differences is key if you want to know how the crypto market functions.

Even from the perspective of traders and investors the definition shifts depending on the seat you’re in. Ask them to describe a crypto fund and investors see a structured vehicle offering exposure to digital assets while traders see layers of compliance, investor decks, and exclusivity which doesn’t let the bottom 99% to take part. Ask about a prop firm, and the tone flips: traders describe speed, algorithms, and skin in the game, while investors only stress uncertainty, high level of risk and strategies that look suspiciously like voodoo chart magic.

This article cuts through those perspectives and lays out both sides — what crypto funds and crypto prop firms really are, how they differ, and why the distinction matters.

To most outsiders, both fall under the same umbrella of “professional traders”. But lumping them together misses the point. The incentives, structures, and even the cultures that drive them are very different — and understanding those differences is key if you want to know how the crypto market functions.

Even from the perspective of traders and investors the definition shifts depending on the seat you’re in. Ask them to describe a crypto fund and investors see a structured vehicle offering exposure to digital assets while traders see layers of compliance, investor decks, and exclusivity which doesn’t let the bottom 99% to take part. Ask about a prop firm, and the tone flips: traders describe speed, algorithms, and skin in the game, while investors only stress uncertainty, high level of risk and strategies that look suspiciously like voodoo chart magic.

This article cuts through those perspectives and lays out both sides — what crypto funds and crypto prop firms really are, how they differ, and why the distinction matters.

What Is a Crypto Fund?

If you’ve ever heard of the infamous hedge funds, you’re already halfway there. A crypto fund is essentially the hedge fund of the digital asset world: it takes the wild, unpredictable swings of crypto markets and tries to turn them into a structured, long-term investment opportunity that promises relatively stable, predictable returns. Think Wall Street… in a hoodie.

The business model of crypto funds is based on pooling money from external investors or limited partners (LPs), which typically consist of organizations with deep pockets (e.g. pension funds, family offices, sovereign wealth funds, etc,) or high net worth individuals. For most of investment fund history — crypto or traditional — everyday retail investors have largely been on the sidelines, though blockchain-based products are starting to democratize access, letting almost anyone participate in a fund-like structure.

The fund typically makes money using a so called ‘2 and 20’ fee structure where the 2% of allocated capital is paid annually as a management fee and then they take a 20% performance fee from the profits earned on investments. The main goal of the fund is to increase the assets under management (AUM), i.e. the amount of money they manage. This provides more income from the management fees while allowing the fund to pursue larger investment opportunities.

The business model of crypto funds is based on pooling money from external investors or limited partners (LPs), which typically consist of organizations with deep pockets (e.g. pension funds, family offices, sovereign wealth funds, etc,) or high net worth individuals. For most of investment fund history — crypto or traditional — everyday retail investors have largely been on the sidelines, though blockchain-based products are starting to democratize access, letting almost anyone participate in a fund-like structure.

The fund typically makes money using a so called ‘2 and 20’ fee structure where the 2% of allocated capital is paid annually as a management fee and then they take a 20% performance fee from the profits earned on investments. The main goal of the fund is to increase the assets under management (AUM), i.e. the amount of money they manage. This provides more income from the management fees while allowing the fund to pursue larger investment opportunities.

Strategies Used by Crypto Funds (Quant, Long-Only, Venture, Macro)

Crypto funds deploy strategies that will feel familiar to anyone who knows traditional finance — just with crypto-flavored twists:

- ▸Long-only / Buy-and-hold – allocate across BTC, ETH and other majors, maybe adding some exposure to smaller altcoins

- ▸Quantitative trading – pairs trading (long ETH, shorth ETH-perp.), basis trades (spot versus futures spreads)

- ▸Venture-style investing – buy seed-stage tokens or early equity in crypto startups

- ▸Directional / Macro trading - BTC as an inflation edge, ETH during regulation uncertainty, position around events, etc.

Culture and Structure of Crypto Funds

The similarity of strategies to Wall Street also extends to the culture these funds usually adopt – they carry themselves with a certain polish. Investor decks, compliance officers, custodians, and audits are all part of the routine, because keeping LPs comfortable is just as important as making good trades. The culture looks less like a buzzing trading floor and more like a hybrid between Wall Street asset management and a crypto-native startup — structured, buttoned-up, and always mindful of optics.

While crypto funds focus on managing external capital and maintaining a polished, regulated image, there’s another side of the crypto trading world that’s a bit rougher around the edges — yet often faster, more flexible, and more directly tied to trading skill rather than fundraising prowess. That’s where crypto prop trading firms come in.

Examples of large crypto funds (AUM): Paradigm ($10bn), Digital Currency group ($50bn), Polychain Capital ($5bn), Pantera Capital ($5bn)

While crypto funds focus on managing external capital and maintaining a polished, regulated image, there’s another side of the crypto trading world that’s a bit rougher around the edges — yet often faster, more flexible, and more directly tied to trading skill rather than fundraising prowess. That’s where crypto prop trading firms come in.

Examples of large crypto funds (AUM): Paradigm ($10bn), Digital Currency group ($50bn), Polychain Capital ($5bn), Pantera Capital ($5bn)

What Is a Crypto Prop Trading Firm?

Crypto prop trading firms are usually tight-knit teams of professional traders that, unlike the crypto funds, manage the firm’s own capital rather than outside money. They are structured enough to have strict rules and rigid risk limits (which are essential to manage the firm’s capital), but nimble enough to pounce on opportunities the moment they appear. There are no LPs, investor decks or AUM to grow – what these firms make or lose comes straight from the firm’s balance sheet and their performance is measured purely in profit and loss.

Freed from outside constraints, prop firms can take bigger, faster, and more flexible positions, adapting instantly to market moves, news, or inefficiencies. Their edge comes not from marketing or reputation, but from speed, strategy, and infrastructure: custom tech stacks, automated bots, low-latency execution systems, and disciplined trading frameworks.

We have written a whole article about the trading strategies commonly used by prop trading firms. The list contains the following but is not exhaustive:

Freed from outside constraints, prop firms can take bigger, faster, and more flexible positions, adapting instantly to market moves, news, or inefficiencies. Their edge comes not from marketing or reputation, but from speed, strategy, and infrastructure: custom tech stacks, automated bots, low-latency execution systems, and disciplined trading frameworks.

We have written a whole article about the trading strategies commonly used by prop trading firms. The list contains the following but is not exhaustive:

Common Trading Strategies in Prop Firms

- ▸Momentum trading

- ▸Mean reversion

- ▸Arbitrage trading

- ▸Breakout trading

- ▸Event-driven narrative trading

Culture and Trader Incentives

Culture-wise, these firms are less about suits and more about the trader’s mindset: focus on rules, discipline, and survivability. Traders are usually profit-sharing, so skill directly drives compensation. Lean, agile, and intensely performance-driven, prop firms are the contrast to crypto funds: they bet their own money, rely on trading skill, and thrive on flexibility — while funds rely on trust, structure, and the polished optics needed to manage other people’s cash.

But the appeal of prop firms isn’t just technical — it’s psychological and cultural. For traders, these firms offer the chance to learn fast, adapt fast, and take ownership of results. There’s no shield of a fund’s reputation or a safety net of external money; success and failure hit home immediately. Decision-making is decentralized and responsive, meaning a trader can pivot mid-day if the market shifts, rather than waiting on committees or approvals. That high-stakes environment attracts a certain type of trader: ambitious, analytical, and willing to embrace both volatility and accountability. the polished optics

Examples of key players in the space: Wintermute, GSR, Auros, Mubite

But the appeal of prop firms isn’t just technical — it’s psychological and cultural. For traders, these firms offer the chance to learn fast, adapt fast, and take ownership of results. There’s no shield of a fund’s reputation or a safety net of external money; success and failure hit home immediately. Decision-making is decentralized and responsive, meaning a trader can pivot mid-day if the market shifts, rather than waiting on committees or approvals. That high-stakes environment attracts a certain type of trader: ambitious, analytical, and willing to embrace both volatility and accountability. the polished optics

Examples of key players in the space: Wintermute, GSR, Auros, Mubite

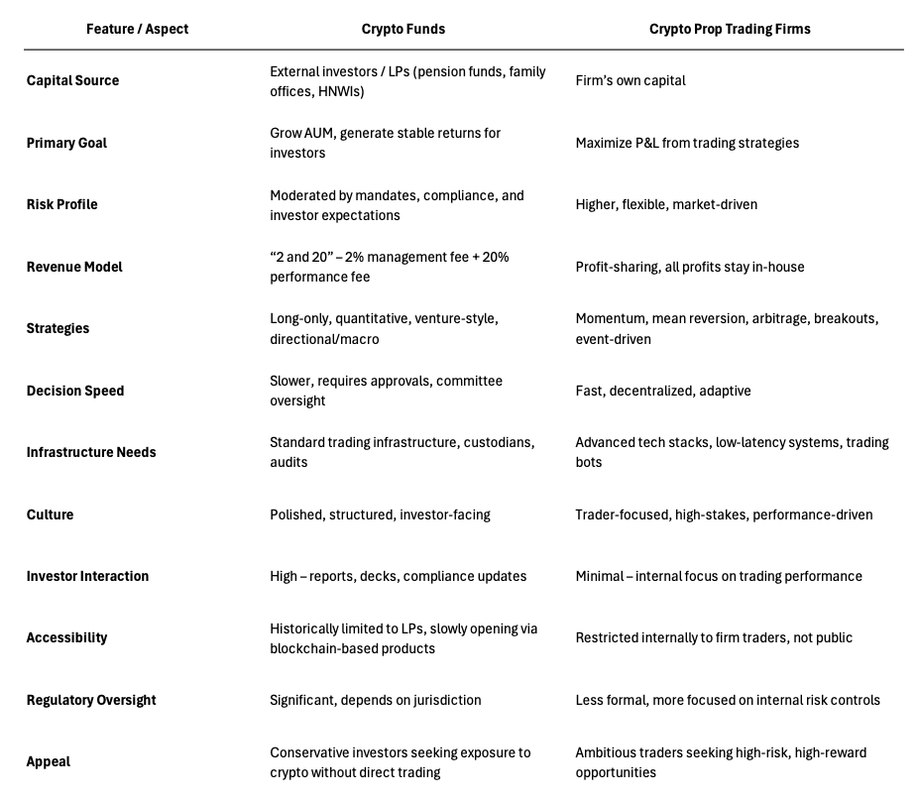

Key Differences Between Crypto Funds and Prop Trading Firms

Why the Distinction Matters

Understanding the difference between crypto funds and prop trading firms isn’t just academic — it has real implications depending on who you are.

For investors, the distinction is about liquidity. If you’re allocating capital, crypto funds are where you can park your money and get exposure to the market in a structured way — you are effectively the liquidity. Prop firms, on the other hand, won’t take your money; they trade their own capital, so your role in their world is mostly observational.

For traders weighing career paths, the difference is even more personal. Crypto funds offer a more structured environment: slower-moving, long-term bets where risk is moderated and the pace is measured. Prop firms, by contrast, are fast, high-stakes, and performance-driven — your results are immediate, and the rewards (or losses) hit directly.

For the industry as a whole, both types of firms play complementary roles. Crypto funds bring institutional capital into the ecosystem, signalling legitimacy and scale. Prop trading firms, meanwhile, provide liquidity, exploit arbitrage opportunities, and help stabilize markets by smoothing inefficiencies.

In the big picture, understanding these distinctions matters because funds and prop firms aren’t competing; they are different gears in the same machine, each critical to the maturation and resilience of crypto markets.

For investors, the distinction is about liquidity. If you’re allocating capital, crypto funds are where you can park your money and get exposure to the market in a structured way — you are effectively the liquidity. Prop firms, on the other hand, won’t take your money; they trade their own capital, so your role in their world is mostly observational.

For traders weighing career paths, the difference is even more personal. Crypto funds offer a more structured environment: slower-moving, long-term bets where risk is moderated and the pace is measured. Prop firms, by contrast, are fast, high-stakes, and performance-driven — your results are immediate, and the rewards (or losses) hit directly.

For the industry as a whole, both types of firms play complementary roles. Crypto funds bring institutional capital into the ecosystem, signalling legitimacy and scale. Prop trading firms, meanwhile, provide liquidity, exploit arbitrage opportunities, and help stabilize markets by smoothing inefficiencies.

In the big picture, understanding these distinctions matters because funds and prop firms aren’t competing; they are different gears in the same machine, each critical to the maturation and resilience of crypto markets.

Two playboooks, one game - Which Model Fits You Best?

At the end of the day, crypto funds and crypto prop trading firms are playing the same game — profiting from the chaos of crypto markets — but with very different playbooks. Funds sell structure: capital allocation, investor exposure, and the polished framework that keeps institutional money comfortable. Prop firms sell skill: edge in trading, execution, and the discipline to survive volatile markets with their own money on the line.

Both matter, both keep the ecosystem moving, and both ultimately shape how crypto matures as an asset class. But don’t confuse them: one plays with other people’s chips, the other with their own.

And if you’re a retail trader trying to sharpen your edge, the lesson probably leans closer to the prop trading mindset. Treat trading like a business: disciplined, rules-based, risk-focused. That’s what keeps professionals in the game long after the gamblers have been wiped off.

Both matter, both keep the ecosystem moving, and both ultimately shape how crypto matures as an asset class. But don’t confuse them: one plays with other people’s chips, the other with their own.

And if you’re a retail trader trying to sharpen your edge, the lesson probably leans closer to the prop trading mindset. Treat trading like a business: disciplined, rules-based, risk-focused. That’s what keeps professionals in the game long after the gamblers have been wiped off.